S Corp Charitable Contributions 2025

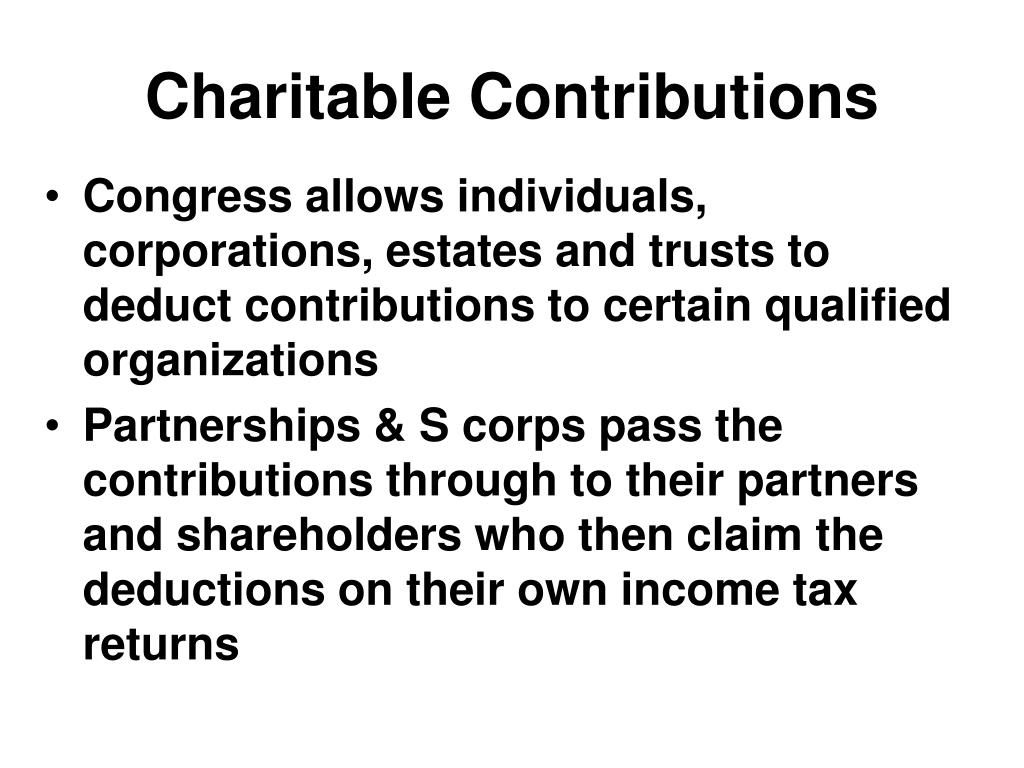

S Corp Charitable Contributions 2025. Rules surrounding the pass through of charitable contribution deductions from an s corporation to its shareholders and the corresponding basis adjustments may also surprise taxpayers. This publication explains how individuals claim a deduction for charitable contributions.

This publication explains how individuals claim a deduction for charitable contributions. Rules surrounding the pass through of charitable contribution deductions from an s corporation to its shareholders and the corresponding basis adjustments may also surprise taxpayers.

This Article Explores The Rules For Contributions To Public.

Rules surrounding the pass through of charitable contribution deductions from an s corporation to its shareholders and the corresponding basis adjustments may also surprise taxpayers.

Closely Held And Personal Service Corporations Must Complete And Attach Form 8283, Noncash Charitable Contributions, To Their Returns If They Claim A Deduction Of More Than.

In final regulations issued in august 2020, the irs provided additional guidance regarding limitations on the deductibility of charitable contributions made in.

S Corp Charitable Contributions 2025 Images References :

Source: www.fidelitycharitable.org

Source: www.fidelitycharitable.org

Donating Privately Held SCorp Stock to Charity Fidelity Charitable, In final regulations issued in august 2020, the irs provided additional guidance regarding limitations on the deductibility of charitable contributions made in. Rules surrounding the pass through of charitable contribution deductions from an s corporation to its shareholders and the corresponding basis adjustments may also surprise taxpayers.

Source: www.slideserve.com

Source: www.slideserve.com

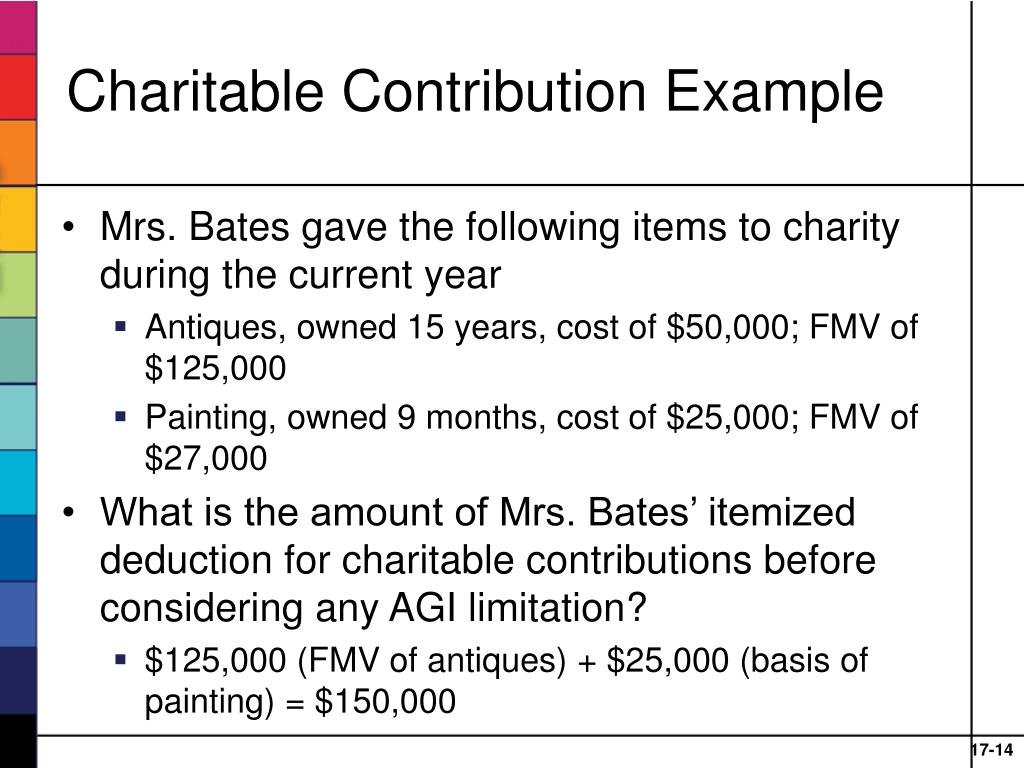

PPT Chapter 11Part A Taxation of Individuals. Deductions For, Closely held and personal service corporations must complete and attach form 8283, noncash charitable contributions, to their returns if they claim a deduction of more than. It discusses the types of organizations to which you can make deductible charitable.

Source: kialbhalette.pages.dev

Source: kialbhalette.pages.dev

S Corp Charitable Contributions 2024 Riki Verene, The shareholder may take only a $40,000 charitable contribution deduction (with a $20,000 basis limitation loss carryover to the next year) as his basis in his s corporation stock. The coronavirus aid, relief, and economic security (cares) act, passed in march 2020, temporarily removed the adjusted gross income (agi) limitation on the.

Source: givinggives.blogspot.com

Source: givinggives.blogspot.com

Charitable Contributions And S Corporations, A qcc is a charitable donation of a qualified real property interest to an eligible organization exclusively for conservation purposes. Charitable contributions originating from s corporations is nuanced and can appear at first somewhat complex to report but is fully legal and advisable.

Source: www.slideserve.com

Source: www.slideserve.com

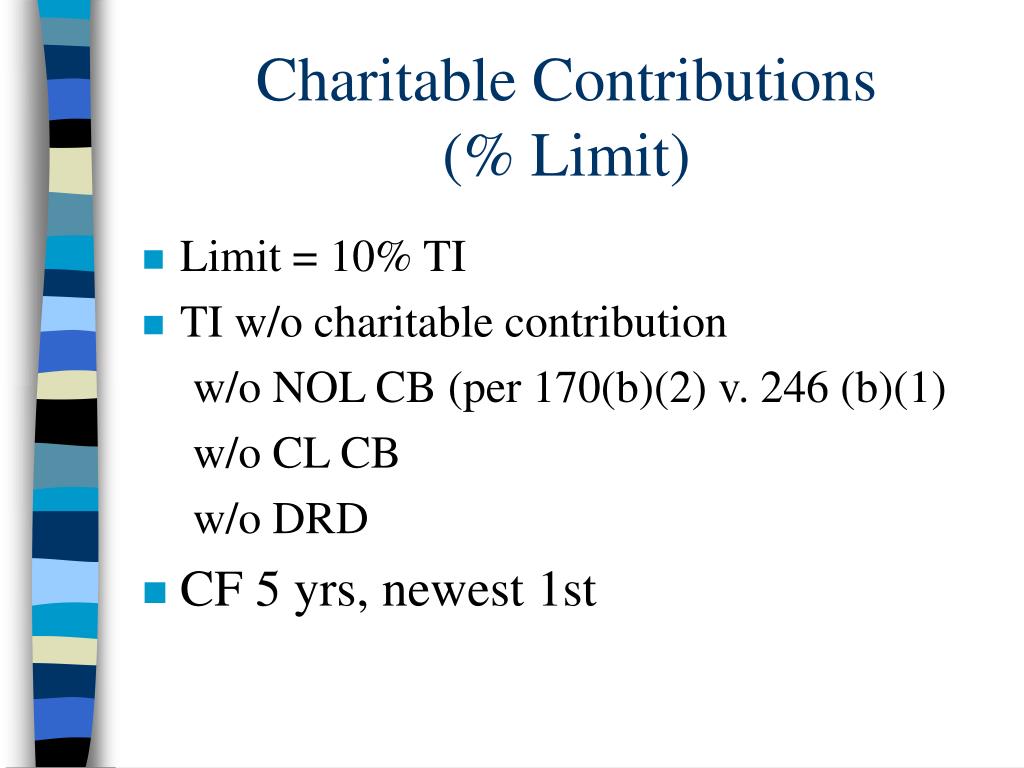

PPT Chapter 17 PowerPoint Presentation, free download ID6965753, In final regulations issued in august 2020, the irs provided additional guidance regarding limitations on the deductibility of charitable contributions made in. Under tax law, a corporation’s charitable deduction for cash contributions generally can’t exceed 10% of its taxable income, as computed with certain modifications.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Chapter 16 Corporations PowerPoint Presentation, free download, In final regulations issued in august 2020, the irs provided additional guidance regarding limitations on the deductibility of charitable contributions made in. Rules surrounding the pass through of charitable contribution deductions from an s corporation to its shareholders and the corresponding basis adjustments may also surprise taxpayers.

Source: www.firstcitizens.com

Source: www.firstcitizens.com

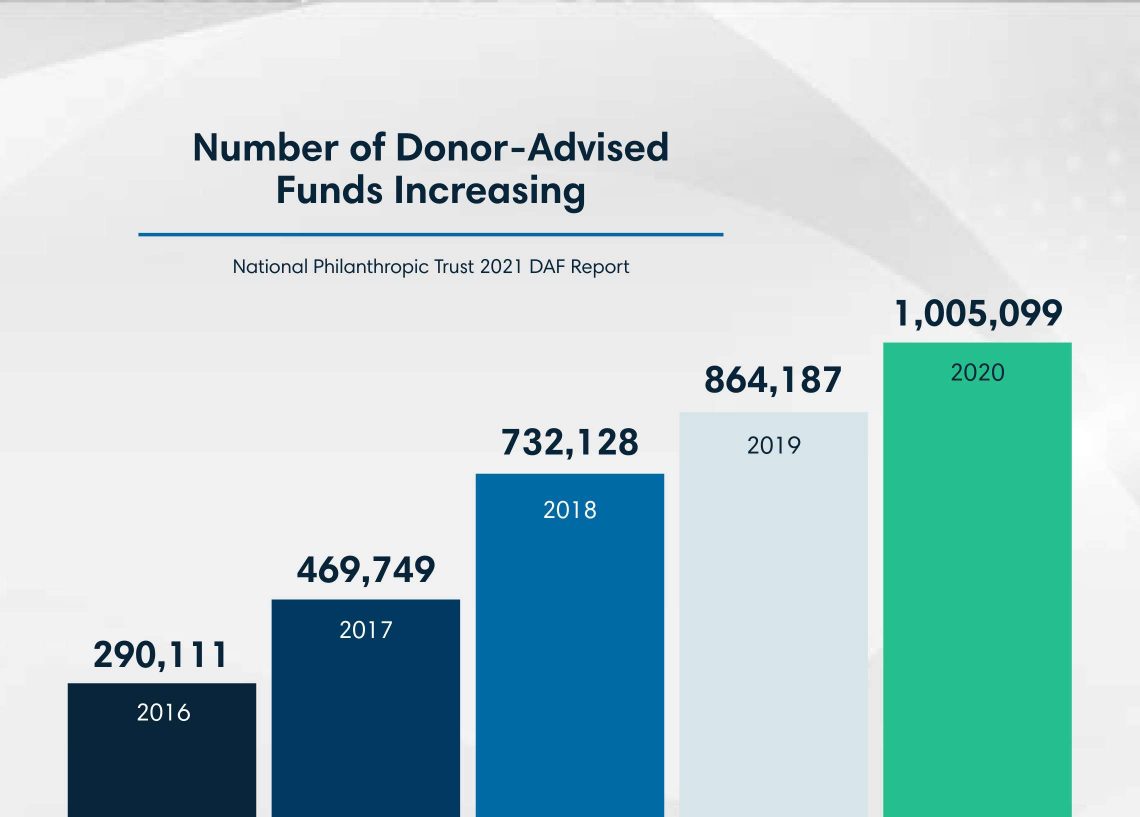

5 Ways to Maximize Charitable Donations First Citizens Bank, In final regulations issued in august 2020, the irs provided additional guidance regarding limitations on the deductibility of charitable contributions made in. This annual update covers recent developments relating to s corporations, including new irs relief for common inadvertent s election lapses;

Source: www.financestrategists.com

Source: www.financestrategists.com

TaxEfficient Charitable Giving Definition, Strategies, Planning, Charitable contributions originating from s corporations is nuanced and can appear at first somewhat complex to report but is fully legal and advisable. In order for expenses to be.

Source: louisettewcarina.pages.dev

Source: louisettewcarina.pages.dev

2024 Charitable Contribution Limits Darcy Melodie, Shareholders in an s corporation may be able deduct the business’s charitable contributions via schedule a of the 1040 form. Cash contributions after 2025 will be limited to 50% of agi.

Source: thefinancialqb.com

Source: thefinancialqb.com

How Charitable Contributions Affect Your Finances The Financial, The shareholder may take only a $40,000 charitable contribution deduction (with a $20,000 basis limitation loss carryover to the next year) as his basis in his s corporation stock. When working on an s corporate return in lacerte, you may come across the need to enter charitable contributions (cash or noncash) for your business client.

This Article Explores The Rules For Contributions To Public.

This publication explains how individuals claim a deduction for charitable contributions.

Employers Could Deduct These Cash Payments As A Business Expense Or As A Charitable.

This annual update covers recent developments relating to s corporations, including new irs relief for common inadvertent s election lapses;